CFO/CEO

Bottom Line for the C-Suite:

Renting equipment transforms fixed costs into strategic flexibility—helping CEOs innovate faster, COOs stay nimble, and CFOs keep the balance sheet clean.

- CEO: Accelerates innovation and time-to-market.

- COO: Adds operational flexibility without long-term commitments.

- CFO: Improves cash flow, preserves capital, and keeps financials clean.

Renting or leasing capital equipment turns fixed costs into flexible ones, empowering leadership to stay nimble, competitive, and capital-efficient.

Renting Capital Equipment Makes Strategic Sense for the C-Suite

Accelerate Speed to Market

Rental equipment is typically ready to ship in days, not months.

Outcome: Faster launch of new products, pilot lines, and promotions—without delays.

Stay Agile with Flexible Capacity

Scale production up or down based on demand, seasonality, or trial runs—without long-term commitments.

Outcome: Adapt quickly, without over-investing in fixed assets.

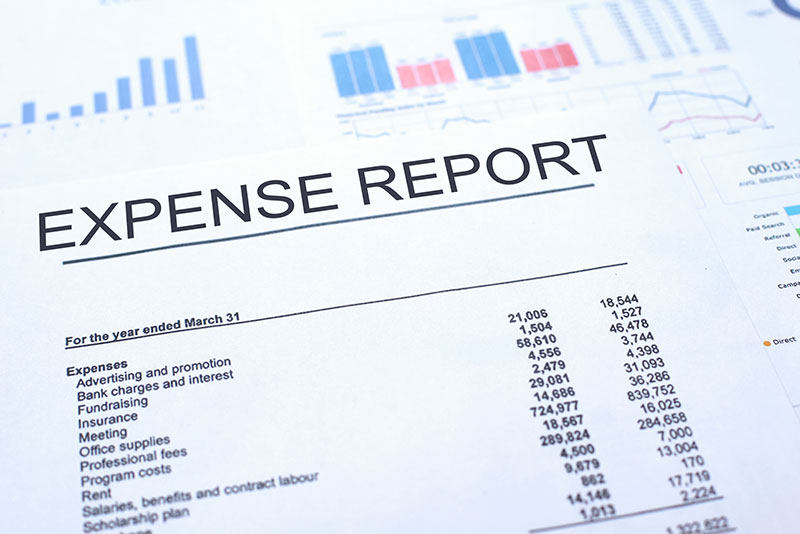

Improve Financial Optics

Rental expenses often stay off the balance sheet and count as OpEx, not debt.

Outcome: Better leverage ratios and financial health—important for audits, investors, or future financing.

Simplify the Approval Process

Operating expenses typically don’t require the same approval hurdles as CapEx.

Outcome: Projects move forward faster, with fewer internal roadblocks.

Minimize Risk & Responsibility

Ownership, maintenance, and risk of obsolescence remain with the rental provider.

Outcome: Less financial and operational burden on your team.

Gain Immediate Tax Benefits

Operating expenses are fully deductible in the year incurred.

Outcome: Improved net income and better year-end cash flow.

Why Renting Makes Iterative Testing Financially Practical

Large-scale production normally requires significant capital investment in specialized food processing and packaging machinery. That’s a major barrier to running small test batches—unless you rent the equipment.

Access to Equipment Without Capital Spend

Avoid multi-million-dollar CapEx requests just to run a limited pilot.

Short-Term Use for Short-Term Needs

Rent equipment only for the duration of a test market or limited run.

Scale Up or Down, Instantly

Try a few SKUs now, and add more lines or shift formats later—without locking into permanent infrastructure.

Fewer Internal Approvals

Operating expenses (OpEx) often bypass capital spending constraints, enabling marketing, innovation, or brand teams to move faster.

Test in Real Production Conditions

Use commercial-grade equipment that mirrors full-scale production, ensuring accurate results.